The PLURIMA Market Neutral UCITS Fund has slashed a 50% net short position in financials to almost neutral and increased its overweight to the IT sector following the annual rebalance of its strategy, which seeks to generate returns from the best and least well-governed US large-cap companies.

The fund, managed by European and Global Advisers LLP (EGA), the London-based investment boutique recently joined by former BlueCrest Capital Management partners Mattias Eriksson and Ebrahim Kasenally, has significantly boosted exposure to financials, primarily through an increased allocation to insurance companies. It has also increased its overweight in the IT sector, through larger allocations to technology stocks including Broadcom and Qualcomm.

The fund, launched in February 2024, takes long positions in the index’s 100 best-governed companies and shorts its 100 least well-governed companies, as determined by the stewardship model provided by leading governance analysts Green Blue Invest, the ESG brand of Cité Gestion SA.

The model, which excludes tobacco, defense and oil & gas companies on its long positions, uses AI and Natural Language Processing to rank the quality of companies’ governance based on analysis of their 10-K reports, comprehensive annual documents US listed businesses are required submit to the Securities and Exchange Commission. These were last filed in April 2024, allowing the model to rebalance according to its evolving proprietary dictionary of 8,000 key words.*

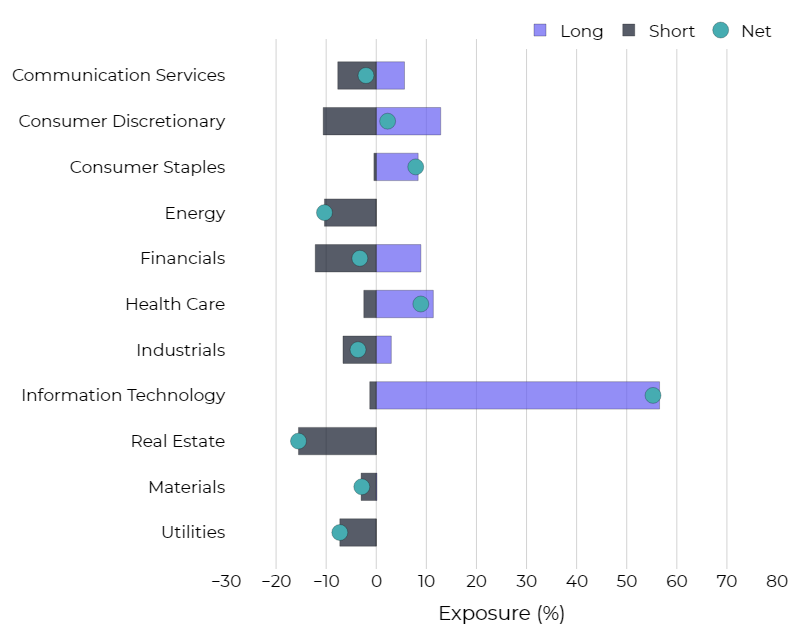

Model positioning following rebalance:

Notable highlights of the rebalance include overweight positions in Consumer Staples, a sector which requires good governance due to the inherent difficulties of managing firms in the space, and Healthcare, with United Healthcare a notable entry into the long side of the portfolio.

On the short side, the model continues to be net short Energy, Real Estate and Utilities. It is also net short Communication Services, with Alphabet the only stock from the sector left in the long book.

More broadly, the model is shifting towards a preference for large cap stocks, with an increase in average market capitalisation.

“It is interesting that we have gone from a large net short position in financials to almost neutral, which reflects optimism in the insurance sector in particular, with our model picking up increased usage of terms like cyber insurance and cyber risk,” says Mattias Eriksson, Partner at EGA.

“It is perhaps less of a surprise that the net overweight to Information Technology has increased, given companies’ continued optimism about their future earnings and their ongoing good organisational structures and governance.

“Our research clearly demonstrates that governance is at the heart of company performance and applying a quantitative approach to assessing its quality allows the fund to systematically gain exposure to the characteristics that are a sustainable forward-looking source of outperformance.”

*Some of the notable changes to the key words within the most recent dictionary include ‘business interruption’, ‘chatbot’, ‘customer experience’, ‘cyber insurance’, ‘cyber risk’, ‘cyber security’, ‘generative AI’, ‘algorithms’, ‘premiums’ and ‘reinsurance’. These key words over 2024 materially affected stewardship and governance scores. The key words for 2023 included ‘Chat GPT’, ‘OpenAI’, ‘Defi’, ‘NFT’, ‘Web3’, ‘Environmental’, ‘Mobilize’ and ‘EAP’.

Media contact

MRMChris Duncan: +44 7717 782997

Andrew Appleyard: +44 7909 684468